Real World Fraud Management with Blockchain

August 8, 2024

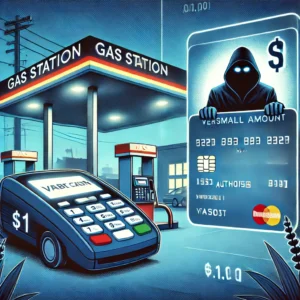

Loopholes in the traditional debit card process have allowed fraud to happen to users and financial institutions (FIs). This vulnerability comes from the two-step process. First, a small amount is sent to verify the account. Then, a separate transaction is made for the total amount. This delay allows fraudsters to create multiple high transactions without being noticed.

When you use your card at a gas station, $1 is sent to verify your account. At the same time, the gas station authorizes the full payment, which is usually higher than $1. It will be permitted if you have enough money in your account during the transaction. The problem is a delay between authorizing the small amount and checking if you have enough money for the full payment.

This delay often goes unnoticed for days. The FI generally relies on third-party processors, who charge fees to both the vendor and the financial institution. When the FI realizes the proper amount of the transaction and tries to take the money from your account, the fraudsters have already taken the funds and disappeared.

There are two significant ways that fraudsters take advantage of this system. First, they can make multiple $1 transactions quickly, even if they don’t have enough money in the account. When the financial institution finds out, the money is already gone. The other way is placing software or hardware in the vendor’s system, which lets them steal money directly from accounts.

How Blockchain Can Help

Small to midsized FIs often struggle with managing fraud due to its increasing complexity. However, there is hope in using distributed ledger technology (DLT) and non-fungible tokens (NFTs) to address these challenges. DLT’s immutability and transparency can provide a secure platform for storing and verifying member information. NFTs, with their embedded metadata, can enhance the verification process and ensure the authenticity of personal information.

The current situation emphasizes the need for a comprehensive and secure approach to fraud management. FIs should consider alternatives to outsourcing and explore the potential of emerging technologies like DLT and NFTs to protect their members’ financial well-being.

Along these lines, DLT is scalable and customizable, allowing FIs to establish standards for validating information and investigating fraud rather than relying on third parties.

Cryptographic Cybersecurity

DLTs use cryptography to encrypt all stored data, ensuring only authorized individuals can access it. Each transaction has a unique and tamper-proof fingerprint called “hashes.” Digital signatures tied to the parties involved are used to verify transactions.

In conjunction with this, immutable digital signatures tied to each party’s PII are used along with node consensus algorithms to verify the transactions. Explained, the unique identifier codes of the transactions, parties, and the network as a whole all work together to secure relevant data.

Enhanced Identity Protection

Blockchain-based credentialing systems offers FIs a stronger solution to mitigate fraud and decrease the amount of time it takes for members to verify their identities during customer service calls. The DLT based “Know-Your-Customer” (KYC) system stores member information in a blockchain ledger, which is protected by a secure network architecture. This information is easily accessible to all FIs sharing the blockchain, allowing for seamless verification and automated authentication. These benefits reduce the risk of errors, fraud, and money laundering while improving customer satisfaction.[i]

Real-Time Transaction Monitoring

Similar to the Know-Your-Customer PII validation procedures referenced above, Know-Your-Transaction (KYT) DLT based procedures improve the ability for financial institutions to mitigate fraud. Since 2019, the KYT system has been used to provide financial institutions with real-time anti-money laundering compliance alerts. The system is designed to generate and send a warning whenever a large amount of money is sent to or received from someone who is considered to be a high risk. This gives FIs more time to investigate and protect their members.[ii]

Improved Risk Assessment

DLT provides FIs with enhanced risk assessment tools, including immutable data storage, improved data quality management, increased transparency, and collaborative capabilities. This allows FIs to assess transaction and member risk levels more effectively. The information stored in DLT is protected from unauthorized modifications and can be accessed by relevant financial institutions for cross-verification purposes.[iii]

Improved Industry Communication

Fraud managers often share the lack of communication across the industry, allowing criminals to exploit different institutions’ disparate fraud prevention strategies. While organizations have facilitated collaboration among fraud managers, this approach is not widely adopted nationwide primarily because establishing connections with counterparts outside of existing personal relationships proves challenging. DLT holds the potential to overcome this obstacle by providing a platform for the seamless and secure exchange of information.

Addressing the vulnerabilities in traditional debit card processes is essential for reducing fraud and protecting both users and financial institutions. The two-step verification process, while initially effective, has become a loophole that fraudsters exploit with increasing sophistication. Emerging technologies like DLT and NFTs offer promising solutions. By leveraging the immutability and transparency of DLT, financial institutions can enhance their fraud detection and prevention capabilities. Additionally, blockchain-based systems for credentialing and transaction monitoring provide real-time alerts and improved identity protection, leading to more secure and efficient financial operations. As the industry moves forward, adopting these innovative approaches will be crucial in creating a more resilient and trustworthy financial ecosystem.

Interested in learning more about our thoughts on this? Reach out to today!

References:

“Credit Union Provider CULedger Launches Blockchain Identity Solution.” Ledger Insights, 2019. Available at: Link

“Chainalysis Introduces Real-Time Alerts for Suspicious Cryptocurrency Transactions.” Chainalysis, 2019. Available at: Link

“DTCC and Accenture Unveil Governance Operating Model to Manage Risks and Promote Safety Across Distributed Ledger Technology Landscape.” Accenture Newsroom, 2019. Available at: Link